PayWay REST API

PayWay is a simple, secure, internet-based solution to collect and manage customer payments.

About PayWay REST API

This page describes the PayWay REST Application Programmer Interface.

Access to the API depends on the PayWay modules you have purchased.

The PayWay Net module allows you to:

- Create a check-out or donations page and process one-time credit card payments

- Maintain full control over the customer experience and styling

- Reduce your PCI-DSS compliance scope by not processing or storing credit card details on your server.

Find out how to accept online payments and reduce PCI-DSS scope.

The PayWay Recurring Billing and Customer Vault module allows you to:

- Store credit card and bank account details in the PayWay customer vault

- Take payments using the stored details individually or using a file

- Reduce your PCI-DSS compliance scope by not processing or storing credit card details on your server

- Schedule regular collection of payments from a customer.

The PayWay Match module allows you to:

- Open virtual accounts for customers who pay you by direct debit/pay anyone.

When a customer pays you by direct credit, PayWay matches the payment to the customer.

Find out how to automatically match EFT payments to customers.

The PayWay Batch module allows you to:

- Process a file of credit card payments

- Download reports indicating which payments were approved or declined.

The PayWay Connect module allows you to:

- Download a machine-readable file listing all received payments for a day.

You can then upload the file into your accounting package.

Other APIs

PayWay supports other ways to interface with your software:

| PayWay Module | Situation |

|---|---|

| PayWay Classic Credit Card API | Process payments by sending credit card details from your PCI-DSS compliant system. |

Quick start

- For test API keys get a free PayWay test facility

- This API is RESTful

- The base URL is https://api.payway.com.au/rest/v1

- Send your API key as the HTTP Basic Auth username. Leave the password blank.

- Send

x-www-form-urlencodedparameters inPUTandPOSTrequests - You can request JSON or XML formatted responses

- Responses contain links to related resources, such as the next page of results

- Duplicate

POSTs can be avoided using anIdempotency-Keyheader - You must implement error handling based on HTTP response codes

- Transactions, customers and receipts files are the most important resources

- To avoid processing credit card details on your server, use single use tokens.

- CORS is not supported

Read next:

- Basics of sending requests and processing responses

- Trusted Frame tutorial or Trusted Frame (SPA) tutorial

- Resources.

Basics

Versioning and base URL

Current version

The current version of this API is version 1.

Base URL

The base URL of the PayWay REST API is https://api.payway.com.au/rest/v1/.

The URLs on this page are relative to the base URL.

Transport layer security

You must connect using https supporting at least TLS version 1.2.

Backwards compatible changes

We will release a new major version of the API if any backwards incompatible changes are made.

If you believe we have made a backwards-incompatible change, please report a defect.

Resources

The following changes to resources will not result in a new API version:

- adding new resources

- supporting new HTTP verbs

- adding new optional request parameters

- adding new properties or XML elements in responses

- changing wording of error message designed to be displayed to users

- improved error reporting when an invalid request is received.

Write your software to handle these types of changes.

Javascript

The following changes to payway.js will not result in a new API version:

- changing resources used internally by

payway.js - adding new properties to objects passed to callback functions

- adding new optional properties to

payway.jsfunctions you call - modifying messages posted between

payway.jsand an iframe hosted by us.

Write your software based on the documented API.

Security

The following changes will not result in a new API version:

- adding or removing TLS ciphers

- changing supported TLS versions

- changing the PayWay server SSL certificate or which certificate authority signs this certificate

- other changes made to improve security.

Authentication

Basic authentication

You must send an API key as the Basic Authentication username. Leave the password blank.

API keys

There are two types of keys:

- Your publishable API key is used by

payway.jsto send credit card details directly from the browser to PayWay - Your secret API key allows your server to process payments and provides full access to the API

Obtaining an API key

To develop and test, get a free PayWay test facility.

To purchase a live PayWay facility, contact us.

Once you have a sign in to view and manage your API keys:

- Sign in to PayWay

- Click Settings

- Click REST API Keys

Secret API keys expire after one year and then you must use a new key. You can automate secret API key renewal.

To test authentication, send a GET to the base url.

Sending requests

HTTP verbs

The standard HTTP verbs are used.

| Verb | Purpose |

|---|---|

GET |

Read a resource |

PUT |

Create or replace a resource when URL is known |

POST |

Create a resource when URL is not known |

PATCH |

Update details of a resource |

DELETE |

Delete a resource |

Requesting JSON or XML

To request JSON responses, send this header:

Accept: application/json

To request XML responses, send this header:

Accept: application/xml

Sending fields for PUT, POST and PATCH

Use the x-www-form-urlencoded content type for sending fields in PUT, POST and PATCH requests.

You must send this header:

Content-Type: application/x-www-form-urlencoded

The request body must contain name/value pairs which have been URL encoded. Use a standard library for URL encoding.

Uploading files

Use the multipart/form-data content type for uploading files.

You must send this header:

Content-Type: multipart/form-data

Use cUrl or a standard library to create the request.

Avoiding duplicate POSTs

You should set a unique value for the Idempotency-Key header on POST requests. Use a UUID for your idempotency key. For example:

Idempotency-Key: a1b22c16-4870-428c-a199-6203cbec7290

This allows requests to be retried after a network failure without accidental duplication. If you receive a network error or timeout, you should resend the request with the same Idempotency-Key.

If you resend a POST request with the same value for the Idempotency-Key, you will receive the original response. If the server is still processing the original POST, you will receive 429 Too Many Requests.

Idempotency keys expire after 24 hours. The maximum length is 60 ascii characters.

Error handling

If you receive a HTTP response code from 200 to 299, the server has accepted your request. When you create a transaction or file you must also check the status in the response body.

If you receive one of these responses, wait 20 seconds and then resend the request with the same Idempotency-Key:

- 429 Too Many Requests

- 503 Service Unavailable

- A transient network error, such as a time-out or closed socket.

If you receive a 422 Unprocessable Entity you may display the error message to your user and allow them to correct the data.

If you receive any other response code, you should log the response code and response body. See: HTTP Response Codes.

Links and pagination

You can follow links returned in responses to related resources. This is known as HATEOAS.

Links are returned in the format shown in the examples.

Open help link URLs in your browser to access developer help (usually this page).

Example links in JSON response

{

"data" : [ {

"example": "one"

}, {

"example": "two"

}

],

"links" : [ {

"rel" : "prev",

"href" : "https://api.payway.com.au/example?page=2"

}, {

"rel" : "next",

"href" : "https://api.payway.com.au/example?page=4"

}

]

}Example links in XML response

<examples>

<data>

<example>one</example>

<example>two</example>

</data>

<links>

<link rel="prev"

href="https://api.payway.com.au/example?page=2" />

<link rel="next"

href="https://api.payway.com.au/example?page=4" />

</links>

</examples>Lists of items

Resources which return lists use a standard structure:

- The

dataJSON property (or XML element) holds up to 20 items - More results can be found by following

nextandprevlinks.

Search URLs

Search URLs are templates:

/search-example?customerNumber={customerNumber}

You must replace parts delimited by braces with actual values.

Dates and times

Dates with no time component are formatted as dd MMM yyyy. An example of such a date is the settlement date, which groups together transactions which are part of the same logical banking day.

Dates with a time component (such as when an event happened) are formatted as dd MMM yyyy HH:mm z. In this case, z represents the timezone.

A credit card expiry month is treated as a two digit string. A credit card expiry year is treated as a two digit string. This matches what is printed on credit cards.

Example of date and times in JSON response

{

"settlementDate": "05 May 2015",

"transactionDateTime": "05 May 2015 13:00 AEST",

"expiryDateMonth": "01",

"expiryDateYear": "22"

}Example of date and times in XML response

<example>

<settlementDate>05 May 2015</settlementDate>

<transactionDateTime>05 May 2015 13:00 AEST</transactionDateTime>

<expiryDateMonth>01</expiryDateMonth>

<expiryDateYear>22</expiryDateYear>

</example>Tutorials

Trusted frame

Use this tutorial to create a server-side rendered web page that takes a one-off credit card payment or stores credit card details in the customer vault. Your server will not store or process credit card details.

It works as follows:

- Your server hosts a web page containing a form and

payway.js - You call

createCreditCardFramewhich creates a PayWay iframe for collecting credit card details - The iframe sends credit card details securely to PayWay

- The iframe sends a single use token to your website

- Your server uses the token in place of the credit card details when you take a payment or create a customer in the customer vault.

Step 1: Host example page

Host this page on your website. Cardholders will enter their details on this page.

<!DOCTYPE html>

<html>

<body>

<!-- this form will POST a single use token to your server -->

<form action="/process-payment" method="post">

<div id="payway-credit-card"></div>

<input id="payway-cc-submit" type="submit" disabled="true"/>

</form>

<script src="https://api.payway.com.au/rest/v1/payway.js">

</script>

<script type="text/javascript">

var submit = document.getElementById('payway-cc-submit');

payway.createCreditCardFrame({

publishableApiKey: '{publishableApiKey}',

onValid: function() { submit.disabled = false; },

onInvalid: function() { submit.disabled = true; }

});

</script>

</body>

</html>Open the page. You should see this error message:

You must replace {publishableApiKey} with your publishable API key when calling payway.createCreditCardFrame()

Step 2: Set publishable API key

- Sign in to PayWay

- Click Settings

- Click REST API Keys

- Click your publishable key (or add a new one)

- Copy the key

- In your web page, replace

{publishableApiKey}with your publishable key.

You may also change /process-payment to a URL you prefer.

Step 3: Test page

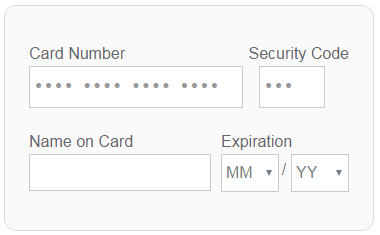

Load your web page, you should see the credit card form.

Enter these card details:

| Field | Value |

|---|---|

| Card Number | 4564 7100 0000 0004 |

| Security Code | 847 |

| Name on Card | Token Tutorial |

| Expiry Date | 02 / 29 |

Click Submit.

Your browser will POST to /process-payment on your server. The POST includes a parameter like this:

singleUseTokenId: 2bcec36f-7b02-43db-b3ec-bfb65acfe272

Step 4: Take payment or save credit card

You can now use the single use token to take a payment or save the credit card to the PayWay customer vault.

When you receive a POST to /process-payment you should:

- Read the single use token from the parameter

- Verify your customer using a session cookie

- Using your secret API key and the single use token, send a request to take a one-time payment.

If you need to take more than one payment with the credit card details, you should store the credit card, optionally verify the stored card and then take payments using stored details.

Step 5: Improve your solution

You must now improve your solution by:

- Avoiding duplicates

- Handling errors

- Protecting your site from card testing

You may also wish to:

- Process payments using stored details

- Style the credit card frame

- Add bank accounts

- Update credit card or bank account for an existing customer.

Trusted frame (SPA)

Use this tutorial to create a single-page application (SPA) that takes a one-off credit card payment or stores credit card details in the customer vault. Your server will not store or process credit card details.

It works as follows:

- Your single page application fetches

payway.js - You call

createCreditCardFramewhich creates a PayWay iframe for collecting credit card details - The cardholder enters their details in the frame

- You call

frame.getTokenand the iframe sends credit card details securely to PayWay - The iframe makes a callback to your application passing a single use token

- You send the single use token to your server using ajax

- Your server uses the token in place of the credit card details when you take a payment or create a customer in the customer vault.

Step 1: Host example page

Host this page on your website. Cardholders will enter their details on this page.

<!DOCTYPE html>

<html lang="en">

<head>

<title>PayWay Trusted Frame Example Code</title>

<meta charset="UTF-8">

</head>

<body>

<h1>PayWay Trusted Frame Example</h1>

<div id="payway-credit-card">

</div>

<br/>

<button id="pay" disabled>Pay</button>

<script src="https://api.payway.com.au/rest/v1/payway.js">

</script>

<script>

"use strict";

const payButton = document.getElementById( "pay" );

let creditCardFrame = null;

const tokenCallback = function( err, data ) {

if ( err ) {

console.error( "Error getting token: " + err.message );

} else {

// TODO: send token to server with ajax

console.log( "singleUseTokenId: " + data.singleUseTokenId );

}

creditCardFrame.destroy();

creditCardFrame = null;

};

payButton.onclick = function() {

payButton.disabled = true;

creditCardFrame.getToken( tokenCallback );

};

const createdCallback = function( err, frame ) {

if ( err ) {

console.error( "Error creating frame: " + err.message );

} else {

// Save the created frame for when we get the token

creditCardFrame = frame;

}

};

const options = {

// TODO: Replace {publishableApiKey} with your key

publishableApiKey: "{publishableApiKey}",

tokenMode: "callback",

onValid: function() { payButton.disabled = false; },

onInvalid: function() { payButton.disabled = true; }

};

payway.createCreditCardFrame( options, createdCallback );

</script>

</body>

</html>Open the page and open the javascript developer console.

You should see this error message:

You must replace {publishableApiKey} with your publishable API key when calling payway.createCreditCardFrame()

Step 2: Set publishable API key

- Sign in to PayWay

- Click Settings

- Click REST API Keys

- Click your publishable key (or add a new one)

- Copy the key

- In your web page, replace

{publishableApiKey}with your publishable key.

Step 3: Test page

Load your web page, you should see the credit card form.

Enter these card details:

| Field | Value |

|---|---|

| Card Number | 4564 7100 0000 0004 |

| Security Code | 847 |

| Name on Card | Token Tutorial |

| Expiry Date | 02 / 29 |

Click Pay.

The single use token will be logged to the javascript console.

singleUseTokenId: 2bcec36f-7b02-43db-b3ec-bfb65acfe272

Step 4: Send token to server

You must now write code to send the token to your server using ajax.

Step 5: Take payment or save credit card

Your server can now use the single use token to take a payment or save the credit card to the PayWay customer vault.

- Read the single use token from the ajax endpoint

- Verify your customer using a session cookie

- Using your secret API key and the single use token, send a request to take a one-time payment.

If you need to take more than one payment with the credit card details, you should store the credit card, optionally verify the stored card and then take payments using stored details.

Step 6: Improve your solution

You must now improve your solution by:

- Avoiding duplicates

- Handling errors

- Protecting your site from card testing

You may also wish to:

- Process payments using stored details

- Style the credit card frame

- Add bank accounts

- Update credit card or bank account for an existing customer.

Use cURL to check network

For your software to work, your server must be able to connect to PayWay. Use this tutorial to determine if a problem is with your network or your software.

Step 1: Download and install cURL

Download and install the cURL client for your platform from http://curl.haxx.se/download.html . Be sure to download the correct distribution for your server's operating system. You must download a version that includes SSL support.

If you are using Windows, we recommend that you download the binary distribution listed under the heading Win32 - Generic labelled Win32 2000/XP, binary and SSL and maintained by Günter Knauf. This document does not provide a direct link because you should always download the latest version.

Step 2: GET the root resource for the API

To test if your server can connect to PayWay:

curl -i --basic --user "{publishableApiKey}:" https://api.payway.com.au/rest/v1

Replace {publishableApiKey} with your Publishable API Key.

If you receive the expected response, your network is working.

Expected response

HTTP/1.1 200 OK

Cache-Control: no-store, no-cache, must-revalidate, proxy-revalidate

Pragma: no-cache

Expires: 0

Content-Type: application/json;charset=UTF-8

Content-Length: 479

Date: Mon, 29 Jun 2015 23:43:13 GMT

{

"clientNumber" : "T10000",

"clientName" : "Demo Pty Ltd",

"keyName" : "T10000_PUB...457",

"links" : [ {

"rel" : "single-use-tokens",

"href" : "https://api.payway.com.au/rest/v1/single-use-tokens"

}, {

"rel" : "surcharges",

"href" : "https://api.payway.com.au/rest/v1/surcharges"

}, {

"rel" : "help",

"href" : "https://www.payway.com.au/docs/rest.html#resources"

} ]

}Troubleshooting

HTTP Response codes other than 200

See HTTP Response Codes.

curl: (60) SSL certificate problem: unable to get local issuer certificate

Your server does not trust the server TLS certificate presented by PayWay. Typically, this is due to an out-dated root CA certificate bundle on your server. Download and install an updated Entrust Certification Authority - L1M root certificate for your server.

curl: (56) Received HTTP code 407 from proxy after CONNECT

Your network has a proxy server. To test if your server can connect to PayWay through the proxy server:

curl --proxy {proxyServer} --proxy-user {proxyUsernamePassword} -i --basic --user "{publishableApiKey}:" https://api.payway.com.au/rest/v1

Your software must connect to PayWay through the proxy server.

curl: (6) Couldn't resolve host 'api.payway.com.au'

DNS resolution failed. You may need to authenticate with your proxy server.

Use Postman to explore API

Postman is a HTTP client for testing RESTful web services. Use Postman when you wish to explore the PayWay REST API.

Step 1: Install postman

- Install Google Chrome

- Open Google Chrome

- Use Google Chrome to install Postman.

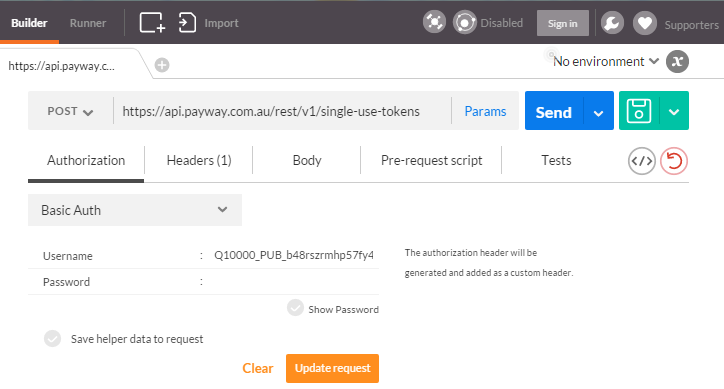

Step 2: Use API key for basic auth

- Start Postman.

- Click the Authorization tab

- Select Basic Auth from the menu

- Enter your Publishable API key into the Username field

- Press Update request.

Step 3: Create single use token

- In Postman's URL bar, select POST

- Enter the URL

https://api.payway.com.au/rest/v1/single-use-tokens - Click the Body tab

- Select the

x-www-form-urlencodedoption - Remove any parameters already present, then type the following parameters:

| Key | Value |

|---|---|

| paymentMethod | creditCard |

| cardNumber | 4564710000000004 |

| expiryDateMonth | 02 |

| expiryDateYear | 19 |

| cvn | 847 |

| cardholderName | Postman tutorial |

- Press Send

- Copy the

singleUseTokenId(e.g. 653fa421-0b91-4855-aef7-bf51a81a153e) from the response and save it for later use

Step 4: Create customer

- In Postman's URL bar, select POST

- Enter the URL

https://api.payway.com.au/rest/v1/customers - Use your Secret API Key as the Basic Auth Username on the Authorization tab

- Click the Body tab

- Select the

x-www-form-urlencodedoption - Remove any parameters already present, then type the following parameters:

| Key | Value |

|---|---|

| singleUseTokenId | the value you saved earlier e.g. 653fa421-0b91-4855-aef7-bf51a81a153e |

| merchantId | TEST |

- Press Send

Step 5: Explore further

- In Postman's URL bar, select GET

- Enter the URL

https://api.payway.com.au/rest/v1 - Press Send

- Click links in the response to open them in a new tab in Postman. Use Postman to send requests to these resources.

Use cURL to download a receipts file

Use this tutorial to automate downloading of your daily receipts file. Complete the cURL network connectivity tutorial first to ensure cURL can connect to PayWay.

To download receipts files through this REST API, you must add the PayWay Connect module and choose a receipts file format.

Step 1: Add PayWay Connect

To add PayWay Connect, your administrator must:

- Sign in to PayWay

- Click Settings

- Click PayWay Connect

- Proceed to add the module.

Step 2: Choose a receipts file format

To choose a receipts files format:

- Sign in to PayWay

- Click Settings

- Click Receipts Files

- Choose a file format and Save.

Step 3: Save API Key to file

- Enter the following into a text file:

basic

user={secretApiKey}:

silent

show-error

fail- Replace

{secretApiKey}with your Secret API Key - Save the file as

payway-curl-config.txt

Step 4: Download a receipts file

To download a receipts file:

curl --config payway-curl-config.txt https://api.payway.com.au/rest/v1/receipts-files/{yyyy-MM-dd}

Replace {yyyy-MM-dd} with the settlement date.

Step 5: Download yesterday's receipts file

Linux

To download yesterday's receipts file using Linux:

curl --config payway-curl-config.txt https://api.payway.com.au/rest/v1/receipts-files/$(date -I --date=yesterday)

Windows Powershell

To download yesterday's receipts file using Windows Powershell:

curl --config payway-curl-config.txt https://api.payway.com.au/rest/v1/receipts-files/$((Get-Date).AddDays(-1).ToString('yyyy-MM-dd'))

Step 6: Save a receipts file to the current folder

To save the receipts file instead of displaying it on screen:

curl -OJ --config payway-curl-config.txt https://api.payway.com.au/rest/v1/receipts-files/{yyyy-MM-dd}

Step 7: Improve your solution

You may now improve your solution by:

- Logging errors

- Automating the process by creating a scheduled task - refer to your operating system's documentation

- Import the file you have downloaded into your accounting system

Other references:

Troubleshooting

curl: (22) The requested URL returned error: 404 Not Found

PayWay does not have a receipts file for the requested settlement date. PayWay creates files shortly after 3 am Sydney time each day. The receipts file contains transactions from the previous settlement day. Receipts files are available for 365 days.

To see which receipts files are available:

- Sign in to PayWay

- Click Receipts Files under the Reports menu

curl: (23) Failed writing body (0 != 1)

You have already saved the receipts file to the current folder. To save a new copy:

- Backup the receipts file already saved

- Delete the receipts file

- Run the command again

curl: (60) SSL certificate problem: unable to get local issuer certificate

Your server does not trust the server TLS certificate presented by PayWay. Typically, this is due to an out-dated root CA certificate bundle on your server. Download and install an updated Entrust Certification Authority - L1M root certificate for your server.

curl: (56) Received HTTP code 407 from proxy after CONNECT

Your network has a proxy server. To test if your server can connect to PayWay through the proxy server:

curl --proxy {proxyServer} --proxy-user {proxyUsernamePassword} -i --basic --user "{publishableApiKey}:" https://api.payway.com.au/rest/v1

Your software must connect to PayWay through the proxy server.

curl: (6) Couldn't resolve host 'api.payway.com.au'

DNS resolution failed. You may need to authenticate with your proxy server.

Use cURL to upload a payment file

Use this tutorial to upload a payment file. Complete the cURL network connectivity tutorial first to ensure cURL can connect to PayWay.

To upload a payment file, you must purchase the PayWay Recurring Billing and Customer Vault module, or the PayWay Batch module.

Step 1: Purchase required module

To purchase PayWay Recurring Billing and Customer Vault or PayWay Batch, contact us.

Step 2: Generate a payment File

Your software must generate a file in one of the payment file formats. Each file must have a unique name.

In this tutorial, we assume the file is called example.dat.

Step 3: Save API key to file

- Enter the following into a text file:

basic

user={secretApiKey}:

silent

show-error

fail- Replace

{secretApiKey}with your Secret API Key - Save the file as

payway-curl-config.txt

Step 4: Upload a payment file

To upload a payment file:

curl --config payway-curl-config.txt -F "file=@example.dat" https://api.payway.com.au/rest/v1/payment-files

Step 5: Improve your solution

You may now improve your solution by:

- Logging errors

- Automating the process by creating a scheduled task - refer to your operating system's documentation

- Polling the status of your file

- Downloading errors in your file and reporting them to your staff

Resources

PayWay allows you to store credit card and bank account details against your customers. You can process payment transactions using the stored details.

You can open virtual accounts for customers who pay you by direct credit/pay anyone. Each of your customers uses a different virtual account. When a payment is sent to a virtual account, PayWay matches the payment to that customer.

Upload a payment file to process transactions in bulk.

Single use tokens are used to avoid processing credit card details on your server.

Your merchants and your bank accounts are used for transaction processing and settlement.

Custom fields allow you to store extra information against each customer.

PayWay can calculate and apply surcharges.

Download receipts files containing a machine-readable list of payments received.

The base URL of the PayWay REST API is https://api.payway.com.au/rest/v1/.

Root

This resource is the top level of the REST API.

To test your network connectivity and API key is working correctly, send a GET to this resource.

Get root resource

GET /

You may access this resource with either your secret or publishable API key.

Model

| Field | Notes |

|---|---|

| clientNumber | Issued by us to uniquely identify your PayWay facility |

| clientName | The name of your business |

| keyName | The name of the API key you sent |

The response includes links to top level resources.

Transactions

Transactions may be payments, refunds, pre-authorisations, captures or account verifications. An account verification checks if a customer's credit card is valid. A pre-authorisation reserves money on your customer's credit card. Later, a capture debits the reserved money.

You can:

- take a one-time payment using credit card details entered into a PayWay trusted frame, your mobile app or provided by a third-party wallet provider

- take payments using the credit card or bank account stored against a customer

- reserve money on a credit card by processing a pre-authorisation and later process a capture to charge the credit card

- void a transaction to cancel it prior to settlement

- refund a credit card, bank account direct debit or direct credit payment

- search and get details of transactions, regardless of how they were originally processed.

To get all transactions processed on a day, see Receipts Files.

Besides this API, PayWay also has other ways to process payments.

Take payment

To take a one-time credit card payment, first get a single use token and then:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| singleUseTokenId | A token issued by PayWay which holds credit card details. See single use tokens. |

| customerNumber | Your reference for the customer. Up to 20 letters and digits. Case insensitive. Leading zeroes ignored if entirely numeric. Customer does not need to exist in the customer vault. |

| transactionType | payment |

| principalAmount | The amount of the payment before any surcharge is added. |

| currency | aud |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| merchantId | This merchant will be used for payment processing and settlement. |

| customerIpAddress | If the cardholder entered their card number directly send their IPv4 or IPv6 address. If your staff entered the card number, do not send this field. See customer IP address. |

| threeDS2 | Optional. true if you have implemented EMV 3-D Secure Version 2. |

In the same request, you may also send custom fields.

Avoid duplicate payments

To avoid processing duplicate payments:

- send a unique

Idempotency-Keyheader - if you receive a network error, resend the request with the same

Idempotency-Key - if you receive

500 Internal Server Error, contact Technical Support - if you receive

503 Service Unavailable, the payment has not been processed. Wait 20 seconds and resend the request with a new idempotency key. Contact Technical Support if you continue to experience problems.

- enable Fraud Guard

- send the

customerIpAddressif your customers trigger payments directly - protect against card testing

Take payment using stored card or account

To take a payment using credit card or bank account stored against a customer:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| customerNumber | This customer's credit card or bank account will be used to process the payment. |

| transactionType | payment |

| principalAmount | The amount of the payment before any surcharge is added. |

| currency | aud |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| customerIpAddress | If the cardholder triggered this payment directly send their IPv4 or IPv6 address. Otherwise do not send this field. See customer IP address. |

You must handle errors and avoid duplicates and reduce your fraud risk.

Merchant ID / Your Bank Account

PayWay will process the payment using the merchant or settlement bank account from the customer's payment setup. To use a different settlement bank account or merchant, send:

| Field | Notes |

|---|---|

| merchantId | If the customer is paying by credit card, the merchant to be used for payment processing and settlement. Ignored otherwise. |

| bankAccountId | If the customer is paying by bank account direct debit, your bank account to be used for payment processing and settlement. Ignored otherwise. |

Verify a stored card

To verify a credit card stored against a customer:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| customerNumber | This customer's credit card will be verified. |

| transactionType | accountVerification |

| currency | aud |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| customerIpAddress | If the cardholder initiated the card registration, send their IPv4 or IPv6 address. Otherwise do not send this field. See customer IP address. |

You must handle errors and avoid duplicates and reduce your fraud risk.

Merchant ID

PayWay will process the payment using the merchant from the customer's payment setup. To use a different merchant, send:

| Field | Notes |

|---|---|

| merchantId | The merchant to be used for payment processing and settlement. |

Process pre-authorisation

To process a credit card pre-authorisation, first get a single use token and then:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| singleUseTokenId | A token issued by PayWay which holds credit card details. See single use tokens. |

| customerNumber | Up to 20 letters and digits. Case insensitive. Leading zeroes ignored if entirely numeric. Uniquely identifies a customer. |

| transactionType | preAuth |

| principalAmount | The amount of the pre-authorisation before any surcharge is added. |

| currency | aud |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| merchantId | This merchant will be used for processing. |

| customerIpAddress | If the cardholder triggered this pre-authorisation directly send their IPv4 or IPv6 address. If your staff entered the card number, do not send this field. See customer IP address. |

| threeDS2 | Optional. true if you have implemented EMV 3-D Secure Version 2. |

In the same request, you may also send custom fields.

You must handle errors and avoid duplicates and reduce your fraud risk.

Later, you can capture the pre-authorisation to charge the card.

Process pre-authorisation using stored credit card

To process a credit card pre-authorisation using the credit card stored against a customer:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| customerNumber | This customer's credit card will be used to process the pre-authorisation. |

| transactionType | preAuth |

| principalAmount | The amount of the pre-authorisation before any surcharge is added. |

| currency | aud |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| customerIpAddress | If the cardholder triggered this pre-authorisation directly send their IPv4 or IPv6 address. Otherwise, do not send this field. See customer IP address. |

Merchant ID

PayWay will process the pre-authorisation using the merchant from the customer's payment setup. To use a different merchant, send:

| Field | Notes |

|---|---|

| merchantId | This merchant will be used for processing. |

You must handle errors and avoid duplicates and reduce your fraud risk.

Later, you can capture the pre-authorisation to charge the card.

Capture a pre-authorisation

To capture a pre-authorisation:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| transactionType | capture |

| parentTransactionId | The transactionId of the pre-authorisation |

| principalAmount | The amount of the capture before any surcharge is added. Send a positive value. |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| customerIpAddress | If the cardholder triggered this capture directly send their IPv4 or IPv6 address. Otherwise, do not send this field. See customer IP address. |

In the same request, you may also send custom fields.

You must handle errors and avoid duplicates and reduce your fraud risk.

Void a transaction

To void a transaction:

POST /transactions/{transactionId}/void

Do not send any fields.

If you void a transaction, it will not appear on your customer's statement or form part of your settlement total. To determine if a transaction can be voided, get the transaction details and use the isVoidable field.

Refund a payment

To refund a payment:

POST /transactions

You must send:

| Field | Notes |

|---|---|

| transactionType | refund |

| parentTransactionId | The transactionId of the payment to be refunded. |

| principalAmount | The amount of the refund before any surcharge is added. Send a positive value. |

| orderNumber | Optional. Your reference for this transaction. At most 20 ascii characters. |

| customerIpAddress | If the cardholder triggered this refund directly send their IPv4 or IPv6 address. Otherwise, do not send this field. See customer IP address. |

In the same request, you may also send custom fields.

To avoid processing duplicate refunds, send a unique Idempotency-Key header and handle errors as described above.

To determine if a payment can be refunded, get the transaction details and use the isRefundable field. The refund will credit the bank account or credit card used on the payment. You can never refund more than the payment amount.

Custom fields

To provide values for custom fields for a transaction:

| Field | Notes |

|---|---|

| customField1 | Optional. Value for your first custom field. |

| customField2 | Optional. Value for your second custom field. |

| customField3 | Optional. Value for your third custom field. |

| customField4 | Optional. Value for your fourth custom field. |

Use custom fields to store additional information about your transaction. You must first set up a master list of custom fields in your PayWay facility. Each field can store 60 ASCII characters.

Search transactions

To search for transactions:

GET /transactions/search-customer?customerNumber={customerNumber}

GET /transactions/search-receipt?receiptNumber={receiptNumber}

GET /transactions/search-order?orderNumber={orderNumber}

These are paginated resources. Most recent transactions are first.

The following fields are returned for each transaction:

| Field | Notes |

|---|---|

| transactionId | Uniquely identifies a transaction |

| receiptNumber | Receipt number to display to customers |

| status | approved, approved*, pending, declined, voided or suspended. See transaction status. |

| transactionType | payment, refund, preAuth, capture or accountVerification |

| customerNumber | |

| orderNumber | A reference number for this transaction, generated by you. |

| currency | aud |

| paymentAmount | Total amount of payment, including any surcharge. Negative for a refund. |

| settlementDate | The day on which this transaction was considered to have been processed |

| declinedDate | The day on which this transaction was considered to have been declined. |

Get transaction details

To get details of a transaction:

GET /transactions/{transactionId}

Transactions model

| Field | Notes |

|---|---|

| transactionId | Uniquely identifies a transaction. |

| receiptNumber | Receipt number to display to customers (not always same as transactionId). |

| status | approved, approved*, pending, declined, voided or suspended. See transaction status. |

| responseCode | Reason code for the status. |

| responseText | Reason description for the status. |

| transactionType | payment, refund, preAuth, capture or accountVerification |

| customerNumber | Customer to which this payment belongs. |

| customerName | |

| customerEmail | |

| bpayRef | A reference number used by this customer when paying by BPAY®. |

| orderNumber | A reference number for this transaction, generated by you. |

| customerBankReference | For a directCredit, the reference entered by the customer when sending payment |

| currency | aud |

| principalAmount | Amount before any surcharge added. Negative for a refund. |

| surchargeAmount | Amount of surcharge. See surcharges. |

| paymentAmount | Total amount of transaction. Principal amount plus surcharge. |

| paymentMethod | creditCard, bankAccount, directCredit, australiaPost, bpay, westpacBranch, remittanceProcessingService or payPal. |

| creditCard | If a creditCard transaction, customer's credit card. |

| merchant | If a creditCard transaction, your merchant facility. |

| bankAccount | If a bankAccount transaction, customer's direct debit bank account. |

| virtualAccount | If a directCredit transaction, the virtual account which the customer credited. |

| australiaPost | If an australiaPost transaction, details of the Australia Post payment. |

| bpay | If a bpay transaction, details of the BPAY payment. |

| yourBankAccount | If a bankAccount, directCredit, bpay, australiaPost, westpacBranch or remittanceProcessingService transaction your settlement bank account. |

| customerPayPalAccount | If a payPal transaction, customer's PayPal account. |

| yourPayPalAccount | If a payPal transaction, your PayPal account. |

| transactionDateTime | Date and time (if known) when transaction processing was initiated. |

| user | The user who processed the payment manually. |

| settlementDate | The day on which this transaction was considered to have been processed. |

| declinedDate | The day on which this transaction was considered to have been declined. |

| parentTransaction | If a refund, the original payment. If a capture, the original pre-authorisation. |

| customerIpAddress | IP address your customer used to connect and process the transaction (if applicable). See customer IP address. |

| fraudResult | Outcome of Fraud Guard checks. See Fraud Result. |

| customerIpCountry | If suspended because of the country the customer connected from, the two character code of that country |

| cardCountry | If suspended because of the country of the bank which issued the credit card, the two character code of that country |

| customFields | Values for any custom fields. See Transaction Custom Fields. |

| isVoidable | If true, this transaction may be voided. See Void a Transaction. |

| isRefundable | If true, this payment may be refunded. See Refund a Payment. |

Example transaction JSON response

{

"transactionId" : 1179985404,

"receiptNumber" : "1179985404",

"status" : "approved",

"responseCode" : "11",

"responseText" : "Approved VIP",

"transactionType" : "payment",

"customerNumber" : "1",

"customerName" : "Po & Sons Pty Ltd",

"customerEmail" : "henry@example.net",

"currency" : "aud",

"principalAmount" : 100.00,

"surchargeAmount" : 1.00,

"paymentAmount" : 101.00,

"paymentMethod" : "creditCard",

"creditCard" : {

"cardNumber" : "456471...004",

"expiryDateMonth" : "02",

"expiryDateYear" : "19",

"cardScheme" : "visa",

"cardType" : "credit",

"cardholderName" : "Po & Sons Pty Ltd"

},

"merchant" : {

"merchantId": "4638116",

"merchantName": "MEGS BEAUTY AND NAILS",

"settlementBsb": "133-605",

"settlementAccountNumber": "172174",

"surchargeBsb": "133-606",

"surchargeAccountNumber": "172131"

},

"transactionDateTime" : "12 Jun 2015 18:22 AEST",

"user" : "BILLC786",

"settlementDate" : "13 Jun 2015",

"isVoidable" : true,

"isRefundable": false

}Example transaction XML response

<transaction>

<transactionId>1179985404</transactionId>

<receiptNumber>1179985404</receiptNumber>

<status>approved</status>

<responseCode>11</responseCode>

<responseText>Approved VIP</responseText>

<transactionType>payment</transactionType>

<customerNumber>1</customerNumber>

<customerName>Po & Sons Pty Ltd</customerName>

<customerEmail>henry@example.net</customerEmail>

<currency>aud</currency>

<principalAmount>100.00</principalAmount>

<surchargeAmount>1.00</surchargeAmount>

<paymentAmount>101.00</paymentAmount>

<paymentMethod>creditCard</paymentMethod>

<creditCard>

<cardNumber>456471...004</cardNumber>

<expiryDateMonth>02</expiryDateMonth>

<expiryDateYear>19</expiryDateYear>

<cardScheme>visa</cardScheme>

<cardType>credit</cardType>

<cardholderName>Po & Sons Pty Ltd</cardholderName>

</creditCard>

<merchant>

<merchantId>4638116</merchantId>

<merchantName>MEGS BEAUTY AND NAILS</merchantName>

<settlementBsb>133-605</settlementBsb>

<settlementAccountNumber>172174</settlementAccountNumber>

<surchargeBsb>133-606</surchargeBsb>

<surchargeAccountNumber>172131</surchargeAccountNumber>

</merchant>

<transactionDateTime>12 Jun 2015 18:22 AEST</transactionDateTime>

<user>BILLC786</user>

<settlementDate>13 Jun 2015</settlementDate>

<isVoidable>true</isVoidable>

<isRefundable>false</isRefundable>

</transaction>Transaction status

| Status | Meaning |

|---|---|

| approved | A successful transaction. |

| approved* | A successful transaction during period when it may be declined or dishonoured. |

| pending | Currently processing. |

| declined | An unsuccessful transaction. See responseCode and responseText for more. |

| voided | Originally approved, but then cancelled prior to settlement. Does not appear on your customer's statement or form part of your settlement total. |

| suspended | An unusual payment for you to review. See fraudResult for more. |

Note:

- Bank account direct debit transactions may be declined by your customer's bank for three banking days after processing

- Cheques may be dishonoured up to five banking days after processing.

Credit card

These fields are returned under the creditCard field:

| Field | Notes |

|---|---|

| cardNumber | Masked credit card number. |

| expiryDateMonth | Two digit expiry month. |

| expiryDateYear | Two digit expiry year. |

| cardScheme | visa, mastercard, unionpay, amex, diners, eftpos or jcb. |

| cardType | credit or debit if cardScheme is visa or mastercard. |

| cardholderName | The name printed on the card. |

| walletType | applePay or googlePay if the customer paid by digital wallet. |

| panType | fpan if a full card number was provided, dpan if a digital card number was provided. |

Customer bank account

These fields are returned under the bankAccount field:

| Field | Notes |

|---|---|

| bsb | The bank-state-branch holding their account. |

| accountNumber | The account number at that branch. |

| accountName | Name of account holder. |

Example bank account JSON response

{

"bsb" : "000-000",

"accountNumber" : "123123",

"accountName" : "Jenny Nguyen"

}Example bank account XML response

<bankAccount>

<bsb>000-000</bsb>

<accountNumber>123123</accountNumber>

<accountName>Jenny Nguyen</accountName>

</bankAccount>Virtual account

A virtual account is used to accept direct credit payments from a customer.

These fields are returned under the virtualAccount field:

| Field | Notes |

|---|---|

| bsb | The bank-state-branch holding the virtual account |

| accountNumber | The virtual account number |

Example virtual account JSON response

{

"bsb": "037-889",

"accountNumber": "80000000"

}Example virtual account XML response

<virtualAccount>

<bsb>037-889</bsb>

<accountNumber>80000000</accountNumber>

</virtualAccount>Customer PayPal account

These fields are returned under the customerPayPalAccount field:

| Field | Notes |

|---|---|

| payPalEmail | Email address your customer used to register with PayPal |

| payPalName | Payer name |

Australia Post

This field is returned under the australiaPost field:

| Field | Notes |

|---|---|

| cheque | true if paid by cheque |

BPAY

This field is returned under the bpay field:

| Field | Notes |

|---|---|

| bank | A code for the bank used by the customer |

Fraud result

Fraud Guard suspends unusual credit card payments. You can review suspended payments and choose to complete or cancel them.

You must send the customerIpAddress in order to have payments checked by Fraud Guard. See customer IP address for more information.

fraudResult indicates if the payment was checked by Fraud Guard:

| Fraud Result | Notes |

|---|---|

| ok | Payment was not unusual |

| skip | Fraud Guard was skipped for this payment |

| velcty | Many payments using the same credit card were made in a short period of time |

| lrgamt | Payment is unusually large |

| hrskip | Customer connected from a high-risk country (e.g. Nigeria). See customerIpCountry |

| anprxy | Customer connected using an anonymous or suspicious proxy |

| blckip | Customer connected from country where you do not do business. See customerIpCountry |

| blkbin | The bank which issued the credit card is not in a country where you do business. See cardCountry |

| binmip | Customer is in a different country to the bank which issued the credit card. See customerIpCountry and cardCountry |

| blkipa | IP address is blocked |

| blkpan | Credit card number is blocked |

| error | Contact Technical Support |

If fraudGuard is not in the response, the payment was not checked by Fraud Guard.

To review suspended payments:

- Sign in to PayWay

- Click Suspended in the Transactions menu

To configure Fraud Guard:

- Sign in to PayWay

- Click Settings

- Click Fraud Guard under the PayWay Modules heading

Transaction custom fields

customFields contains a list of the transaction's custom fields.

These fields are returned for each customField:

| Field | Notes |

|---|---|

| customFieldId | A number from 1 to 4 |

| fieldName | Name for the custom field |

| fieldValue | Value for the custom field for this transaction |

| required | true or false. If true, this field was mandatory when this transaction was created. |

| hidden | true or false. If true, this field was hidden from customers (e.g. in receipt emails). |

| links | parent link to the master configuration of the custom field (not shown in examples). |

When the master list of custom fields is modified, existing transactions do not change.

Example custom fields JSON response

{

"data" : [ {

"customFieldId" : 1,

"fieldName" : "Campaign Id",

"fieldValue" : "489590",

"required" : false,

"hidden" : true

}, {

"customFieldId" : 2,

"fieldName" : "Membership Type",

"fieldValue" : "social",

"help" : "e.g. junior, senior, social",

"required" : false,

"hidden" : false

} ]

}Example custom fields XML response

<customFields>

<data>

<customField>

<customFieldId>1</customFieldId>

<fieldName>Campaign Id</fieldName>

<fieldValue>489590</fieldValue>

<required>false</required>

<hidden>true</hidden>

</customField>

<customField>

<customFieldId>2</customFieldId>

<fieldName>Membership Type</fieldName>

<fieldValue>social</fieldValue>

<help>e.g. junior, senior, social</help>

<required>false</required>

<hidden>false</hidden>

</customField>

</data>

</customFields>Customers

PayWay Recurring Billing and Customer Vault stores your customer's credit card or bank account details. You can process payments using the stored details. Your PCI-DSS compliance scope is reduced when your server does not store or process credit card details.

PayWay Match allows you to open virtual accounts for customers who pay you by direct credit/pay anyone. When a customer pays you by direct credit, PayWay matches the payment to the customer.

Store credit card or bank account for new customer

For step-by-step instructions, see Trusted Frame tutorial.

To store a credit card or bank account in the customer vault:

POST /customers to have PayWay generate the customer number

PUT /customers/{customerNumber} to use your own customer number

Send these fields:

| Field | Notes |

|---|---|

| singleUseTokenId | A token issued by PayWay which holds credit card or bank account details. See single use tokens. |

| merchantId | If token contains a credit card, the merchant to be used for payment processing and settlement. Ignored otherwise. |

| bankAccountId | If token contains a bank account, your bank account to be used for payment processing and settlement. Ignored otherwise. |

| threeDS2 | Optional. true if the token contains a credit card and you have implemented EMV 3-D Secure Version 2. |

merchantId=TEST and bankAccountId=0000000A

In the same request, you may also send:

- regular schedule of payments

- contact details

- custom fields

- notes.

You should send an Idempotency-Key to ensure customers are not duplicated if there is a network problem.

The response is the full customer model.

Next, you may wish to verify the stored card prior to processing payments.

Open a virtual account for new customer

To create a customer and open a virtual account:

POST /customers to have PayWay generate the customer number

PUT /customers/{customerNumber} to use your own customer number

Send these fields:

| Field | Notes |

|---|---|

| virtualAccountStatus | open |

| bankAccountId | Your bank account used for settlement |

bankAccountId=0000000A

In the same request, you may also send:

The response is the full customer model, including the virtual account.

You should send an Idempotency-Key to ensure customers are not duplicated if there is a network problem.

List customers

To list customers:

GET /customers

This is a paginated resource.

The following fields are returned for each customer:

| Field | Notes |

|---|---|

| customerNumber | Unique identifier for a customer. |

| customerName | Name of business or individual. |

Get customer details

To get the full customer model:

GET /customers/{customerNumber}

Alternatively, use these URLs to get only that part of the customer model:

GET /customers/{customerNumber}/payment-setup

GET /customers/{customerNumber}/schedule

GET /customers/{customerNumber}/virtual-account

GET /customers/{customerNumber}/contact

GET /customers/{customerNumber}/custom-fields

GET /customers/{customerNumber}/notes

Schedule regular payments

PayWay can automatically process payments according to a regular schedule.

To set a new schedule for a customer:

PUT /customers/{customerNumber}/schedule

Send the fields listed in Customer Schedule.

The new schedule replaces any previous schedule.

If a scheduled payment is due, PayWay will process it before responding. To get details of the payment follow the transaction link in the response.

Stop regular schedule

To stop any more automatic payments being processed by PayWay:

DELETE /customers/{customerNumber}/schedule

You may continue to process individual payments using the stored payment setup.

Stop all payments

To stop any new payments using the stored credit card or bank account:

PATCH /customers/{customerNumber}/payment-setup

Send this field:

| Field | Notes |

|---|---|

| stopped | true |

If the customer has a schedule, it is stopped.

Later, to allow the stored credit card or bank account to be used again:

PATCH /customers/{customerNumber}/payment-setup

Send this field:

| Field | Notes |

|---|---|

| stopped | false |

Update credit card or direct debit bank account

To store a new credit card or direct debit bank account for an existing customer:

PUT /customers/{customerNumber}/payment-setup

Send these fields:

| Field | Notes |

|---|---|

| singleUseTokenId | A token issued by PayWay which holds credit card or bank account details. See single use tokens. |

| merchantId | Required if token contains a credit card. Ignored otherwise. |

| bankAccountId | Required if token contains a bank account. Ignored otherwise. |

| threeDS2 | Optional. true if the token contains a credit card and you have implemented EMV 3-D Secure Version 2. |

Update the settlement account for a customer

To change the settlement account for transactions made with a specific customer:

PATCH /customers/{customerNumber}/payment-setup

Send only one of the below fields, depending on the customer's payment method:

| Field | Notes |

|---|---|

| merchantId | Required if the customer has a credit card linked. Considered an error otherwise. |

| bankAccountId | Required if the customer has a bank account linked. Considered an error otherwise. |

Update contact details

To update customer name, contact details and email preference:

PUT /customers/{customerNumber}/contact

Send name, address, phone number and email preference fields.

Open a virtual account

To open a virtual account for an existing customer:

PUT /customers/{customerNumber}/virtual-account

Send these fields:

| Field | Notes |

|---|---|

| virtualAccountStatus | open |

| bankAccountId | Your bank account for settlement |

The response is the new virtual account.

Close a virtual account

To close a virtual account:

PATCH /customers/{customerNumber}/virtual-account

Send this field:

| Field | Notes |

|---|---|

| virtualAccountStatus | closed |

Update settlement for virtual account

To update the settlement account used for a virtual account:

PATCH /customers/{customerNumber}/virtual-account

Send this field:

| Field | Notes |

|---|---|

| bankAccountId | Your bank account for settlement |

Update custom fields

To update custom fields:

PUT /customers/{customerNumber}/custom-fields

Send custom field values fields.

Update notes

To update notes:

PUT /customers/{customerNumber}/notes

Send a single notes field.

To remove the notes:

DELETE /customers/{customerNumber}/notes

Calculate surcharge

To calculate the surcharge payable by a customer:

GET /customers/{customerNumber}/surcharge?principalAmount={principalAmount}

The following fields are returned:

| Field | Notes |

|---|---|

| principalAmount | The amount before any surcharge is added. As passed in query parameter. |

| surchargeAmount | Amount of surcharge payable by this customer, based on their payment setup. |

| paymentAmount | Total amount of payment, including the surcharge. |

| currencyCode | aud |

See surcharges.

Example customer surcharge JSON response

{

"principalAmount" : 100.00,

"surchargeAmount" : 1.11,

"paymentAmount" : 101.11,

"currencyCode" : "aud"

}Example customer surcharge XML response

<customerSurcharge>

<principalAmount>100.00</principalAmount>

<surchargeAmount>1.11</surchargeAmount>

<paymentAmount>101.11</paymentAmount>

<currencyCode>aud</currencyCode>

</customerSurcharge>Delete customer

DELETE /customers/{customerNumber}

A customer can not be deleted if they:

- have been issued a PayWay Payment Card

- have a payment in their payment history

- have pending payments

- have an active recurring schedule.

Customer model

A customer in PayWay is uniquely identified by a customer number.

The customer model consists of:

- Payment setup - customer's credit card or direct debit bank account

- Contact details - name, email, phone number and address

- Custom fields - values for fields you have defined

- Notes - free text

- Payment schedule - a regular series of payments to be processed using the payment setup

- Virtual account - an account used to accept direct credit payments from the customer.

| Field | Notes |

|---|---|

| customerNumber | Up to 20 letters and digits. Case insensitive. Leading zeroes ignored if entirely numeric. Uniquely identifies a customer. |

The customer may be paying by either credit card or bank account direct debit.

The customer's payment details include their credit card or bank account details, which merchant ID or bank account should be used for transaction processing and the surcharge payable on transactions.

Example customer JSON response

{

"customerNumber" : "98",

"paymentSetup" : {

"paymentMethod" : "creditCard",

"stopped" : false,

"creditCard" : {

"cardNumber" : "376000...006",

"expiryDateMonth" : "06",

"expiryDateYear" : "20",

"cardScheme" : "amex",

"cardholderName" : "Rebecca Turing",

"surchargePercentage" : 1.543

},

"merchant" : {

"merchantId": "4638116",

"merchantName": "MEGS BEAUTY AND NAILS",

"settlementBsb": "133-605",

"settlementAccountNumber": "172174",

"surchargeBsb": "133-606",

"surchargeAccountNumber": "172131"

}

},

"contact" : {

"customerName" : "Rebecca Turing",

"emailAddress" : "bect@example.net",

"sendEmailReceipts" : true,

"phoneNumber" : "04 9999 8888",

"address" : {

"street1" : "12 Test St",

"street2" : null,

"cityName" : "Wombat",

"state" : "NSW",

"postalCode" : "2587"

}

},

"customFields" : {

"customField1" : "Senior"

},

"notes" : {

"notes" : "Example notes"

} ,

"virtualAccount" : {

"bsb" : "037-889",

"accountNumber" : "80000000",

"virtualAccountStatus" : "open",

"yourBankAccount" : {

"bankAccountId": "133605172174A",

"remitterName": "MEGS BEAUTY AND NAILS",

"accountName": "MEGAN ZUCKER",

"settlementBsb": "133-605",

"settlementAccountNumber": "172174"

}

}

}Example customer XML response

<customer>

<customerNumber>98</customerNumber>

<paymentSetup>

<paymentMethod>creditCard</paymentMethod>

<stopped>false</stopped>

<creditCard>

<cardNumber>376000...006</cardNumber>

<expiryDateMonth>06</expiryDateMonth>

<expiryDateYear>20</expiryDateYear>

<cardScheme>amex</cardScheme>

<cardholderName>Rebecca Turing</cardholderName>

<surchargePercentage>1.543</surchargePercentage>

</creditCard>

<merchant>

<merchantId>4638116</merchantId>

<merchantName>MEGS BEAUTY AND NAILS</merchantName>

<settlementBsb>133-605</settlementBsb>

<settlementAccountNumber>172174</settlementAccountNumber>

<surchargeBsb>133-606</surchargeBsb>

<surchargeAccountNumber>172131</surchargeAccountNumber>

</merchant>

</paymentSetup>

<contact>

<customerName>Rebecca Turing</customerName>

<emailAddress>bect@example.net</emailAddress>

<sendEmailReceipts>true</sendEmailReceipts>

<phoneNumber>04 9999 8888</phoneNumber>

<address>

<street1>12 Test St</street1>

<street2/>

<cityName>Wombat</cityName>

<state>NSW</state>

<postalCode>2587</postalCode>

</address>

</contact>

<customFields>

<customField1>Senior</customField1>

</customFields>

<notes>

<notes>Example notes</notes>

</notes>

<virtualAccount>

<bsb>037-889</bsb>

<accountNumber>80000000</accountNumber>

<virtualAccountStatus>open</virtualAccountStatus>

<yourBankAccount>

<bankAccountId>133605172174A</bankAccountId>

<remitterName>MEGS BEAUTY AND NAILS</remitterName>

<accountName>MEGAN ZUCKER</accountName>

<settlementBsb>133-605</settlementBsb>

<settlementAccountNumber>172174</settlementAccountNumber>

</yourBankAccount>

</virtualAccount>

</customer>Customer payment setup

To store credit card or bank account details, send these fields:

| Field | Notes |

|---|---|

| singleUseTokenId | A token issued by PayWay which holds credit card or bank account details. See single use tokens. |

| merchantId | Required if token contains a credit card. Ignored otherwise. |

| bankAccountId | Required if token contains a bank account. Ignored otherwise. |

These fields are returned in responses when the customer is paying by credit card:

| Field | Notes |

|---|---|

| paymentMethod | creditCard |

| stopped | true if payments have been stopped, false if these details can be used |

| cardNumber | Masked credit card number. |

| expiryDateMonth | Two digit expiry month. |

| expiryDateYear | Two digit expiry year. |

| cardScheme | visa, mastercard, unionpay, amex, diners, eftpos or jcb. |

| cardType | credit or debit if cardScheme is visa or mastercard. |

| cardholderName | The name printed on the card. |

| surchargePercentage | The percentage to be applied to principal amount to calculate payment amount. |

| merchant | The merchant used for transaction processing and settlement. |

These fields are returned when the customer is paying by bank account direct debit:

| Field | Notes |

|---|---|

| paymentMethod | bankAccount |

| stopped | true if payments have been stopped, false if these details can be used |

| bsb | The bank-state-branch holding their account. |

| accountNumber | The account number at that branch. |

| accountName | Name of account holder. |

| surchargeAmount | Dollar amount added to principal amount to calculate payment amount. |

| yourBankAccount | The bank account used for transaction processing and settlement. |

Customer contact details

The customer's contact details:

| Field | Notes |

|---|---|

| customerName | Name of business or individual. Maximum 60 ASCII characters, letters, numbers and punctuation. |

| emailAddress | Maximum 128 ASCII characters. We validate based on RFC 5322 and RFC 1035. |

| sendEmailReceipts | true or false. If true email receipts are automatically sent for each transaction. |

| phoneNumber | We use the libphonenumber library for validation, with a default country of Australia. |

| street1 | Maximum 128 ASCII characters. |

| street2 | Maximum 128 ASCII characters. |

| cityName | Maximum 60 ASCII characters. |

| state | ACT, NSW, NT, QLD, SA, TAS, VIC or WA. |

| postalCode | A valid four digit Australian post code. |

Customer custom fields

The customer may have values for custom fields:

| Field | Notes |

|---|---|

| customField1 | Value for your first custom field. |

| customField2 | Value for your second custom field. |

| customField3 | Value for your third custom field. |

| customField4 | Value for your fourth custom field. |

Use custom fields to store additional information about your customer. You must first set up a master list of custom fields in your PayWay facility. Each field can store 60 ASCII characters.

Notes

A free text field allowing you to comment on the customer.

| Field | Notes |

|---|---|

| notes | Up to 4000 ASCII characters of free text |

Customer schedule

PayWay can process payments according to a regular schedule. The customer's stored credit card or bank account and surcharge rate is used.

To create a schedule that continues you stop it, send these fields:

| Field | Notes |

|---|---|

| frequency | weekly, fortnightly, monthly, quarterly, six-monthly, yearly. |

| nextPaymentDate | The date on which the next payment will be collected. |

| nextPrincipalAmount | Different amount for the next payment (optional). |

| regularPrincipalAmount | Usual amount for payments. |

To create a schedule that stops after a fixed number of payments, also send:

| Field | Notes |

|---|---|

| numberOfPaymentsRemaining | Number of payments. |

| finalPrincipalAmount | Different amount for the very last payment (optional). |

If you have enabled surcharges, PayWay will calculate and add surcharges to the amounts.

If a scheduled payment is due, PayWay will process it before responding. To get details of the payment follow the transaction link in the response.

These fields are returned:

| Field | Notes |

|---|---|

| frequency | weekly, fortnightly, monthly, quarterly, six-monthly, yearly. |

| nextPaymentDate | When the next automatic payment will be processed. |

| nextPrincipalAmount | Amount of next payment before surcharge is added. |

| nextSurchargeAmount | Surcharge added to next payment. |

| nextPaymentAmount | Amount of the next payment, including any surcharge. |

| regularPrincipalAmount | Regular amount for each payment before surcharge is added. |

| regularSurchargeAmount | Surcharge added to regular amount for each payment. |

| regularPaymentAmount | Amount of each regular payment, including any surcharge. |

If a fixed number of payments, these fields are also returned:

| Field | Notes |

|---|---|

| numberOfPaymentsRemaining | The total number of payments yet to be collected. |

| finalPrincipalAmount | Amount of the very last payment before surcharge is added. |

| finalSurchargeAmount | Surcharge added to the very last payment. |

| finalPaymentAmount | Amount of very last payment, including any surcharge. |

On each payment date, PayWay processes a payment and updates the schedule with the next payment date.

For a fixed schedule, numberOfPaymentRemaining counts down to zero, and then the schedule is deleted.

Example customer schedule JSON response

{

"frequency" : "monthly",

"nextPaymentDate" : "31 Jul 2015",

"numberOfPaymentsRemaining" : 12,

"nextPrincipalAmount" : 100.00,

"nextSurchargeAmount" : 1.00,

"nextPaymentAmount" : 101.00,

"regularPrincipalAmount" : 200.00,

"regularSurchargeAmount" : 2.00,

"regularPaymentAmount" : 202.00,

"finalPrincipalAmount" : 300.00,

"finalSurchargeAmount" : 3.00,

"finalPaymentAmount" : 303.00

}Example customer schedule XML response

<schedule>

<frequency>monthly</frequency>

<nextPaymentDate>31 Jul 2015</nextPaymentDate>

<numberOfPaymentsRemaining>12</numberOfPaymentsRemaining>

<nextPrincipalAmount>100.00</nextPrincipalAmount>

<nextSurchargeAmount>1.00</nextSurchargeAmount>

<nextPaymentAmount>101.00</nextPaymentAmount>

<regularPrincipalAmount>200.00</regularPrincipalAmount>

<regularSurchargeAmount>2.00</regularSurchargeAmount>

<regularPaymentAmount>202.00</regularPaymentAmount>

<finalPrincipalAmount>300.00</finalPrincipalAmount>

<finalSurchargeAmount>3.00</finalSurchargeAmount>

<finalPaymentAmount>303.00</finalPaymentAmount>

</schedule>Virtual account

An account used to accept direct credit payments from the customer.

These fields are returned:

| Field | Notes |

|---|---|

| bsb | BSB for customer to direct credit |

| accountNumber | Account number for customer to direct credit |

| virtualAccountStatus | open, suspended, closed |

| yourBankAccount | Your bank account used for settlement |

All virtual accounts belong to a customer. Each customer may only have one virtual account.

Virtual account status

| Status | Notes |

|---|---|

open

|

Payments made to the virtual account will settle to yourBankAccount. |

suspended

|

Payments made to the account will be returned to the customer. Contact us. |

closed

|

Payments made to the account will be returned to the customer |

Single use tokens

Single use tokens allow you to avoid sending credit card or bank account details to your server.

Tokens are temporary. To store a credit card or bank account, use a token to create a customer in the customer vault.

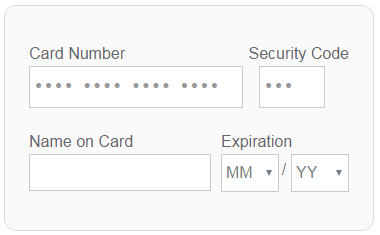

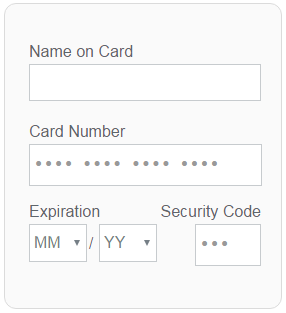

Tokenise credit card (webpage)

To add a PayWay iframe containing credit card fields to your page, include payway.js, create a div with id payway-credit-card, and call payway.createCreditCardFrame.

For step-by-step instructions, see the Trusted Frame tutorial.

For JavaScript reference, see payway.js.

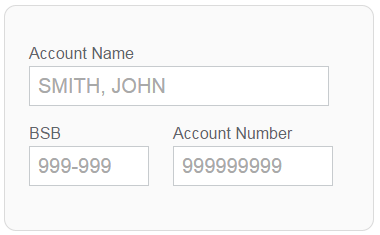

Tokenise bank account (webpage)

To add a PayWay iframe containing bank account fields to your page, include payway.js, create a div with id payway-bank-account, and call payway.createBankAccountFrame.

For JavaScript reference, see payway.js.

Tokenise credit card (mobile app)

To tokenise a credit card from fully PCI-DSS compliant mobile application:

POST /single-use-tokens

Use your publishable API key.

Send these fields:

| Field | Notes |

|---|---|

| paymentMethod | creditCard |

| cardNumber | Digits printed on the card |

| cardholderName | Name printed on the card |

| cvn | Card Verification Number. Also known as Security Code, CVV2 and CVC2. The three or four digit security code. |

| expiryDateMonth | Two digit expiry month |

| expiryDateYear | Two digit expiry year |

Tokenise bank account (mobile app)

To tokenise a direct debit bank account from your mobile application:

POST /single-use-tokens

Use your publishable API key.

Send these fields:

| Field | Notes |

|---|---|

| paymentMethod | bankAccount |

| bsb | The bank-state-branch holding their account. |

| accountNumber | The account number at that branch. |

| accountName | Name of account holder. |

Single use token response

If you send valid fields:

- the credit card or direct debit bank account details are stored by PayWay for 10 minutes

- a

singleUseTokenIdis returned in the response - you should send the token in a request to create a customer in the customer vault.

Alternatively, you can update a customer in the vault.

Example single use token JSON response

{

"singleUseTokenId" : "2bcec36f-7b02-43db-b3ec-bfb65acfe272"

}Example single use token XML response

<singleUseToken>

<singleUseTokenId>2bcec36f-7b02-43db-b3ec-bfb65acfe272</singleUseTokenId>

</singleUseToken>If you send invalid fields, you will receive a 422 Unprocessable Entity response.

3-D Secure Authentication

Authentication is the process of confirming that the person making an e-commerce transaction is entitled to use the payment card.

When you create a single use token and the response indicates threeDS2AuthRequired=true, your next step is to authenticate.

Authenticate

To authenticate the credit card stored in a singleUseToken using 3-D Secure 2:

POST /single-use-tokens/{singleUseTokenId}/three-ds2-authentication

Send these fields:

- Authentication Purpose: the reason for authenticating the card, and your merchant facility

- Purchase Information: the amount and frequency of intended payments