PayWay guide for Batch Advantage merchants

This page outlines how to use PayWay instead of Batch Advantage. PayWay is designed to allow you to accept credit card payments without needing to store the credit card numbers on your systems.

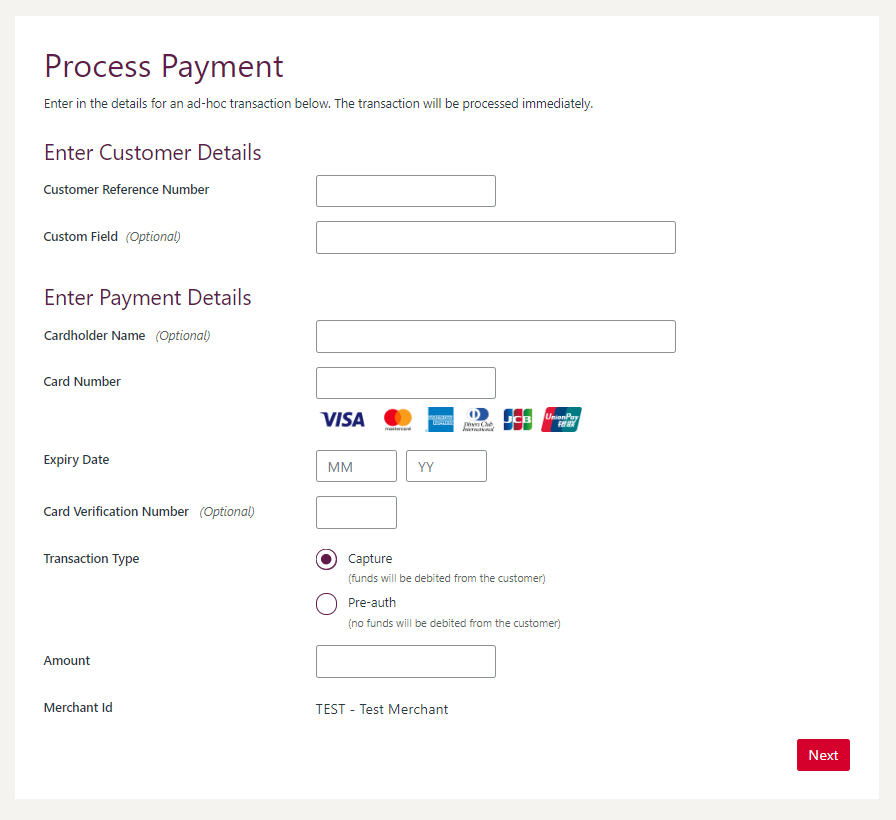

You can process payments in the same way using PayWay Virtual Terminal.

For more information see the PayWay Virtual Terminal online help

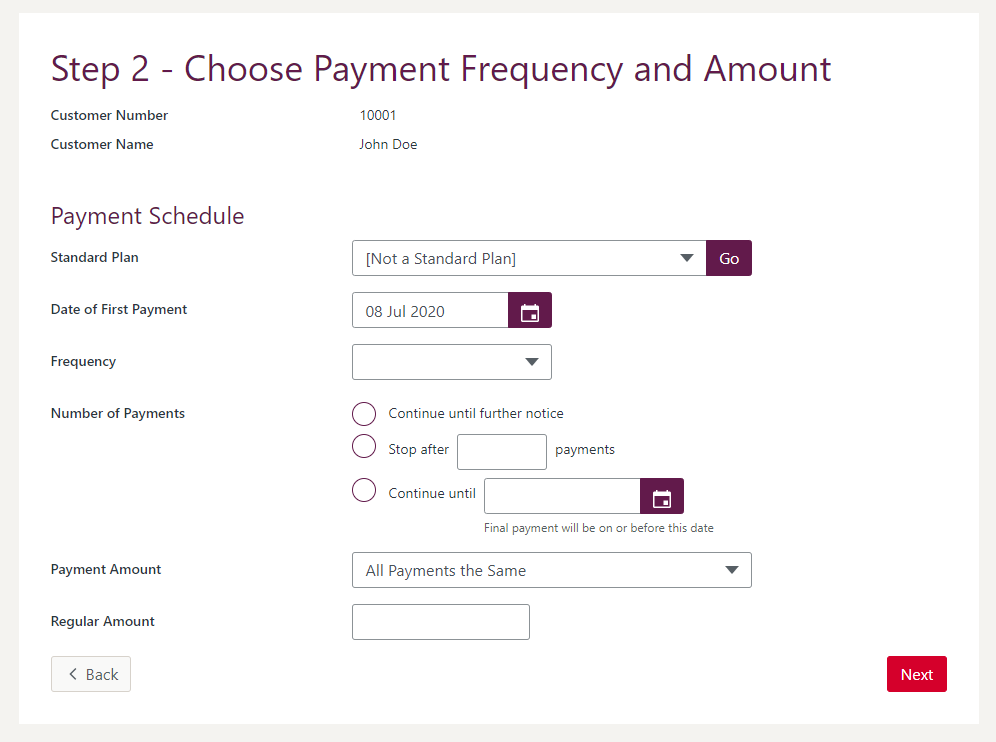

You can use PayWay to collect a series of payments. PayWay stores the schedule of payments and the credit card to charge. On each due day, PayWay processes the payment.

Use this for donations, instalments, subscriptions and memberships.

Don't charge monthly? PayWay also supports other frequencies such as every fortnight.

For more information see the PayWay Recurring Billing and Customer Vault online help

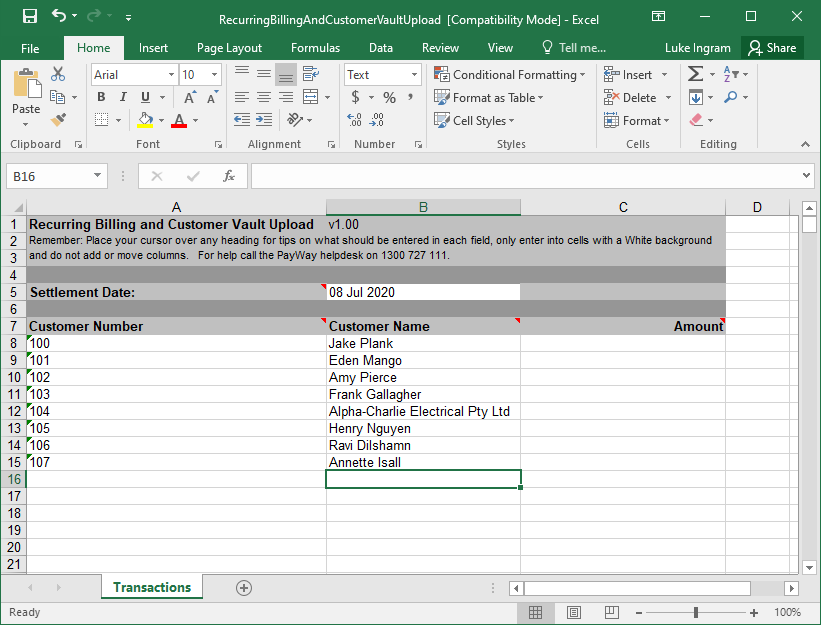

You can use PayWay to store the credit card details. You can upload a simple spreadsheet with a list of customer numbers and the amount to charge. PayWay will collect the payments using the stored details.

Storing the credit card details in PayWay:

- reduces the chance of an account data compromise impacting your business

- reduces your compliance costs

If your systems store or process credit card data, you must be compliant with "Self Assessment Questionnaire D" (SAQ-D). For more information about PCI-DSS see the PayWay PCI-DSS Guide

If your organisation and systems are compliant with SAQ-D, you can use PayWay to process files in Westpac MTS format.

Benefits of PayWay

When you use PayWay, you will experience these benefits:

- A settlement report that allows you to export your transactions to a CSV file

- Email receipts to your customers (with your logo)

- Give your customers choice by accepting other payment channels such as direct debit and BPAY

- Charge credit card surcharges

- Mobile and tablet friendly user interface

- Allow your customers to make payments directly online or provide their credit card details using a PayWay hosted page

Contact us

For sales, help and technical support contact us.