PayWay Recurring Billing and Customer Vault

PayWay is a simple, secure, internet-based solution to collect and manage customer payments.

About Recurring Billing and Customer Vault

This page describes the PayWay Recurring Billing and Customer Vault module.

This module allows you to:

- store credit card or bank account details in the PayWay customer vault

- use the stored details to process payments

- set up an automatic schedule of payments.

You can use PayWay Recurring Billing and customer vault for:

- memberships and subscriptions

- donations

- bill payments by direct debit

- fast checkout for returning customers.

Alternative modules

If you wish to store credit card information in your PCI-DSS compliant system, you can instead use the PayWay Credit Card API or PayWay Batch module.

Benefits

- Secure and compliant - customer data is stored securely by PayWay, reducing your PCI-DSS compliance scope

- Improve cash flow - process payments as soon as they are due

- Customer service - offer convenience of direct debit and allow returning online customers to checkout faster

- Ease of integration - simply link to a page hosted by us, or build seamless integration with PayWay Trusted Frames.

PayWay is a PCI-DSS level 1 compliant solution.

How it works

For regular payments like subscriptions, memberships and donations:

- Credit card or bank account details are stored in the PayWay customer vault along with a schedule of payments

- On each due date, PayWay automatically processes the payment

- You receive bulk settlement to your account and a receipts file detailing amount paid by each customer.

For variable payments like utilities or fast checkout for returning customers:

- Credit card or bank account details are stored in the PayWay customer vault against a customer number

- You process payments by providing the customer number and amount

- You receive bulk settlement to your account and a receipts file detailing amount paid by each customer.

You are able to access reports for managing customers and predicting cash flow.

Adding customers

To save credit card or bank account details in the PayWay customer vault, you add a customer.

The ways to add a customer are listed below.

| Method | Use when you want... |

|---|---|

| Once-off customer upload | to transfer all of your existing customers to PayWay |

| Add customer wizard | to manually enter customer details yourself |

| Internet sign up | customers to enter their details directly into PayWay |

| Trusted frames and REST API | to build seamless integration between your website and PayWay |

Tips:

- The customer number may be up to 20 characters long

- You can use letters, numbers, underscores and dashes

- Use the customer number from your accounting system when adding customers

- The customer number is included in receipts files and settlement reports.

Once-off customer upload

To import all of your existing customers to PayWay, use the once-off customer upload.

Use the following instructions and template:

- PayWay Recurring Billing and Customer Vault Once-off Customer Upload

- PayWay_Recurring_Billing_and_Customer_Vault_Once-Off_Customer_Upload_Spreadsheet.xls.

Add customer wizard

To manually enter the customer details:

- Sign in to PayWay

- Click Add Customer in the Customers menu

- Choose Regular Recurring Billing or Variable Recurring Billing as how the customer will pay

- Follow the wizard and enter details of the credit card or bank account.

If you prefer your customers to enter their details themselves, use the internet sign up feature.

Internet sign up

Internet sign up allows your customers to follow a link from your website to PayWay. They can then enter their credit card or bank account details.

To allow your customers to enter their credit card or bank account details only, without a schedule of payments:

- Sign in to PayWay

- Click on Settings

- Click PayWay Recurring Billing and Customer Vault

- Under Sign Up Variable Schedule, click Configure

- At the top of the page, choose Enabled

- Copy the link or HTML displayed into your website

- Click Save.

To allow your customers to enter their credit card or bank account details and choose their own schedule of payments:

- Sign in to PayWay

- Click on Settings

- Click PayWay Recurring Billing and Customer Vault

- Under Sign Up Regular Schedule click Configure

- At the top of the page, choose Enabled

- Copy the link or HTML displayed into your website

- Click Save.

This is useful for donations.

A standard plan is a payment schedule that you offer to customers. To allow your customers to sign up to the standard plan:

- Sign in to PayWay

- Click Settings

- Click PayWay Recurring Billing and Customer Vault

- Click Standard Plans in the menu

- Click Add New Plan and follow the wizard

- On step 3, tick Allow customers to sign up to this plan on the internet

- Once the plan has been saved, copy the link displayed by PayWay into your website.

Use the New Customers report to list customers who have been added to the PayWay customer vault. If you need real-time notification or full control over the user experience, implement the Trusted Frame.

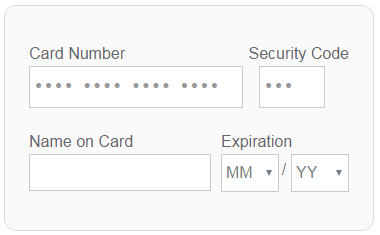

Trusted frame

The PayWay Trusted Frame solution allows you to:

- Embed a PayWay trusted iframe in your customer registration page

- Accept registration and/or payments by credit card or bank account

- Maintain full control over the user experience

- Reduce your PCI-DSS compliance scope

- Integrate using Javascript and REST API.

The trusted frame is part of the PayWay REST API.

For step-by-step instructions, see Trusted Frame Tutorial.

Payments

You can process payments using the credit card or bank account details stored in the PayWay customer vault.

| Method | Use when you want... |

|---|---|

| Process Payment Button | to sign-in and process a single payment |

| Payment File Upload | to process many payments using an upload file |

| REST API | to process payments directly from your system using straight through processing |

| Regular Payment Schedule | PayWay to automatically process regular payments on each due date |

Process payment button

To process a payment using credit card or bank account details stored in the PayWay customer vault:

- Sign in to PayWay

- Click Search in the Customers menu

- Find the customer

- Click the Process Payment button

- Enter the amount and complete the wizard.

This is useful if you have a low volume of payments to process one at a time. If you have many payments, upload a payment file.

Payment file upload

To process payments in bulk using credit card or bank account details stored in the PayWay customer vault:

- Sign in to PayWay

- Click File Upload in the Transactions menu

- If asked for a file type, choose Recurring Billing

- Click the link to download the spreadsheet template containing your customer list

- Enter the amount for any customers you wish to charge

- Upload the spreadsheet and follow the wizard.

If you are generating a file from your accounting system, use the CSV payment file format.

REST API

To automate payment processing use the REST API you can process individual payments or upload a CSV payment file.

Automated processing saves time and reduces errors.

Regular payment schedule

To automatically process payments on each due date, set up a regular schedule when adding the customer to the customer vault. You can also add a schedule to an existing customer, or stop or edit a schedule.

First payment date

You can choose the first or next payment date.

To add the customer before their first payment, you can set a first payment date up to one year in the future. Back dating allows you to set the anniversary on the desired day of the week or day of month.

Frequency

You can choose:

- Weekly

- Fortnightly

- Monthly

- Quarterly

- Six-monthly

- Yearly.

Banking days

When a payment falls on a weekend or national public holiday, it is processed on the next banking day.

Number of payments

The schedule can run for a set number of payments, until a certain date, or continue until stopped.

Payment amounts

If you have a joining or setup fee, you can choose a special first payment amount. If you have a residual or balloon payment, you can choose a special final payment amount.

Reports

PayWay Recurring Billing and Customer Vault payments, refunds and returns are included in reporting along with payments received through other modules.

Receipts files

Receipts files contain a list of payments received, including the customer number used when adding the customer.

PayWay can produce a variety of formats suitable for upload into accounting packages.

The PayWay Transaction Export is a CSV format listing all transactions.

To download receipts files:

- Click Daily Settlement in the Reports menu

- Choose the settlement date

- PayWay displays the total settlement amount and narrative

- Click Download Receipts File or Export All Payments for CSV format.

Transaction search

To search for payments and refunds in the last 365 days:

- Click Search (or Search and Refund) in the Transactions menu

- Enter search details, such as customer number or BSB and account number

- Click Search.

Customer payment history

To access a customer's payment history:

- Click Search and Edit in the Customers menu

- Enter the customer number or customer name

- Click Search

- Choose Payment History and click Go.

Payments from the last 365 days are listed.

Recurring billing reports

To access recurring billing reports:

- Click Recurring Billing in the Reports menu

- Choose a report and click Display.

There are reports for listing your new customers, current customers and customers nearing the end of their regular schedule. The Future Recurring Payment Summary report shows future recurring billing totals based on your customer schedules.

Settlement

Settlement is the process of paying you for transactions which have been processed.

Credit cards

We credit your settlement account on the same day for Mastercard, Visa and UnionPay transactions processed before 6pm AEST on banking days.

St. George customers

UnionPay is not available to St. George customers.Transactions processed on non-banking days or after 6pm AEST are settled on the next banking day.

If you choose to impose payment surcharges and to settle surcharges separately, we will make a separate credit for the aggregate amount of surcharges collected for Mastercard, Visa and UnionPay.

Settlement for other card types depends on your arrangement with those schemes.

Bank account direct debit

We credit your settlement account on the same day for transactions processed before 6pm AEST on banking days. You will receive one bulk credit for the total of:

- all payments collected from regular recurring customers

- all payments processed as automatic or manual retries of declined payments

- all refunds processed.

We will credit your account a separate amount for each payment file processed that day. If the aggregate value of refunds is greater than the aggregate value of payments, we will debit your account.

If you choose to impose payment surcharges and to settle surcharges separately, we will make a separate credit for the aggregate amount of surcharges in accordance with the above credits.

If you use the shared 3-day User ID, the credit will be uncleared funds. This means the credit will increase your balance but the funds will not be available to you. After three banking days the funds will be available to you.

If you have your own direct entry User ID, the credit will be cleared funds.

Direct entry returns

Your customer's bank may refuse to accept the payment from their customer's account. This is known as a direct entry return. This may happen if the account is closed, has insufficient funds, or the customer has asked their bank to stop accepting debits from you.

Westpac customers

We will debit your account an aggregate amount for the total of all direct entry returns we receive on a particular banking day.

If you choose to impose payment surcharges and to settle surcharges separately, we will make a separate debit for the aggregate amount of surcharges returned.

St. George customers

We will debit your account for each direct entry returns we receive on a particular banking day.

If you choose to impose payment surcharges and to settle surcharges separately, we will instead make an aggregate debit and separate debit for the aggregate amount of surcharges returned.

Multiple settlement accounts

PayWay Recurring Billing and Customer Vault allows for more than one settlement account.

To use more than one settlement account:

- Contact us to add settlement accounts to your PayWay facility

- When you add a customer to the vault, select the settlement account that you wish to use.

Payments processed for that customer will settle to the selected account. If using the PayWay REST API, you can select a settlement account on each payment.

You can also change the settlement account for existing customers using the PayWay website or PayWay REST API.

Contact us

For sales, help and technical support contact us.